Quick Summary

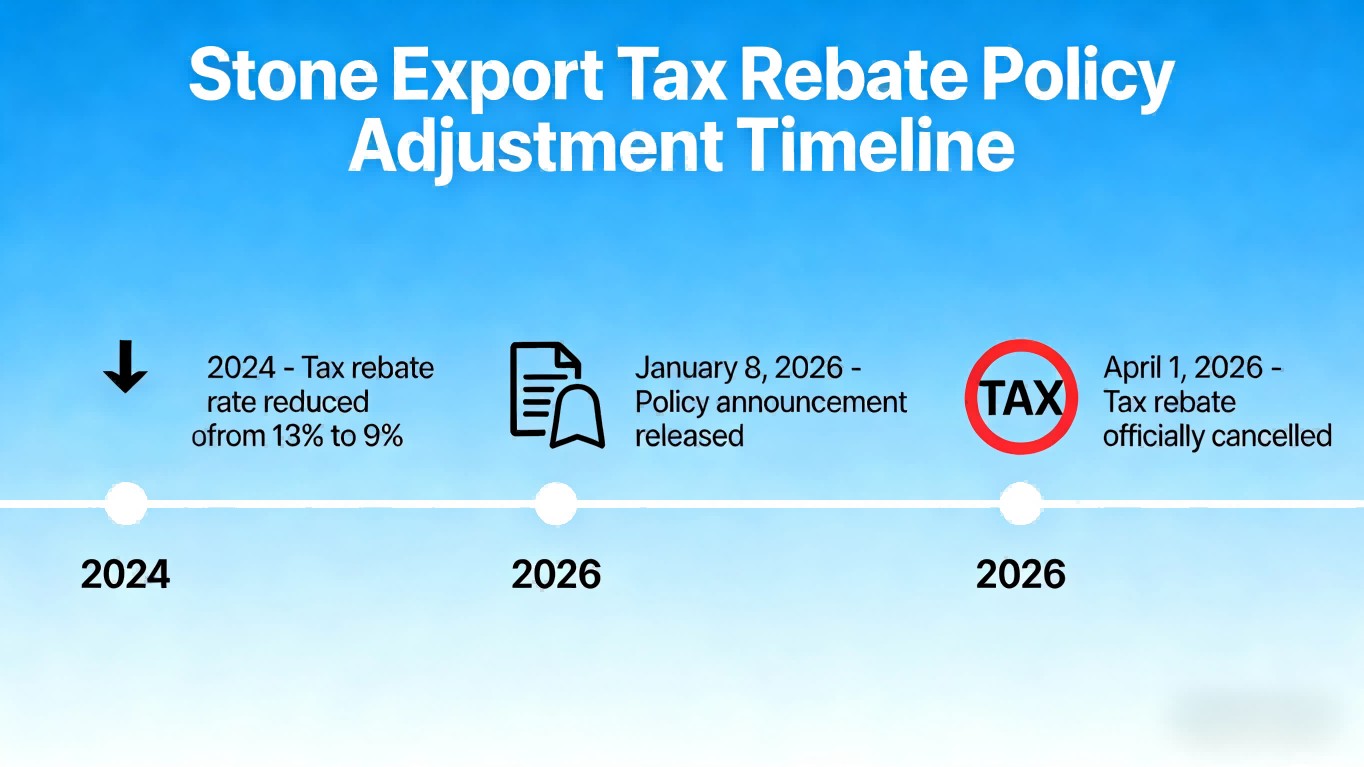

Starting April 1, 2026, China will cancel VAT export rebates on 33 categories of stone products, marking a decisive shift

from low-cost raw material exports to high-value, design-driven stone solutions.

Global buyers can expect market consolidation, moderate price adjustments for basic slabs, and rapid growth in

finished stone goods such as CNC-cut components, stone furniture, and modular systems.

To stay competitive, buyers are advised to secure inventory early, prioritize design-ready finished products,

and partner with stable suppliers that offer advanced manufacturing, reliable logistics, and long-term value creation.

Executive Summary: Starting April 1, 2026, the Chinese government will officially cancel the Value-Added Tax (VAT) export rebates for 33 categories of stone products. While this marks the end of an era for “low-cost raw material exports,” it signals the beginning of a high-value, design-driven future. Here is how this shift will reshape the global supply chain and how you can stay ahead.

1. Understanding the Shift: From “Quantity” to “Quality”

For decades, the global stone market has relied on China as a high-volume hub for raw blocks and basic slabs. However, the new policy effective April 2026—eliminating the long-standing tax rebates for marble, granite, and slate products—is a clear signal from the Chinese Ministry of Finance.

The goal is simple: to discourage the export of resource-heavy primary materials and incentivize high-end, precision-engineered stone products. This is not just a tax change; it is a mandatory “upgrade command” for the entire industry.

2. How This Impacts Global Buyers

As the “price cushion” of government rebates disappears, the international market will experience three major shifts:

-

Market Consolidation: Small, low-tech workshops that relied on tax subsidies to survive are expected to exit the market. This “natural selection” ensures that the remaining suppliers are those with robust financial health, environmental compliance, and advanced manufacturing capabilities.

-

A Shift in Value Proposition: Basic slab prices will undergo an upward price adjustment of 9%–13% due to new cost pressures. Consequently, the value gap between raw and finished products shrinks, shifting competition from price-per-unit to total solution value.

-

Increased Focus on “Finished Goods”: With the policy favoring high-processing depth, buyers will see a surge in innovation within stone furniture, intricate CNC carvings, and modular wall systems—sectors where China’s manufacturing tech now leads the world.

3. Strategic Recommendations for Our Partners

To navigate this transition smoothly, we recommend the following strategies for our international clientele:

-

Secure Inventory Early: To bypass the initial cost surge, we advise finalizing orders for mid-2026 projects before the February 28th deadline. This ensures your shipments clear customs under the current tax framework.

-

Prioritize “Design-Ready” Products: Instead of importing raw slabs and processing them locally (at higher labor costs), consider sourcing finished components. Our investment in Intelligent Digital Manufacturing allows us to provide precision-cut, project-ready pieces that offset the rising material costs through reduced on-site labor and waste.

-

Verify Supplier Stability: In this “shake-out” period, the reliability of your partner is paramount. Ensure your supplier has the technical infrastructure and global logistics network to withstand domestic policy changes.

4. Our Commitment: Building Value Beyond the Stone

في HRST Stone, we view this policy shift as an opportunity to redefine our partnership with you. We are moving beyond being a “stone supplier” to becoming your “Space Solutions Partner.”

By integrating AI-driven cutting technology and sustainable quarrying practices, we are absorbing parts of the cost increase through operational efficiency. Our focus remains on delivering the “three P’s”: Precision, Predictability, and Premium Aesthetics.

Closing Thoughts: The 2026 policy change is a milestone in the maturation of the global stone trade. It challenges us to move away from commodity-based competition and toward a future defined by craftsmanship and innovation. We thank you for your continued trust as we step into this premium era of Chinese stone together.

Q1: Why is the Chinese government cancelling the stone export tax rebate?

A: This is part of a long-term national strategy to transition from “resource-intensive” to “high-value-added” manufacturing. By removing rebates for 33 categories of primary stone products, the government aims to curb the export of raw materials and encourage the industry to focus on precision engineering, architectural design, and sustainable production. It is a mandatory push toward global industry leadership.

Q2: How exactly will this impact the pricing of my upcoming orders?

A: For shipments departing after April 1, 2026, the loss of the 9%–13% tax rebate will lead to a market price adjustment. Depending on the product type and processing depth, customers may see a net increase of approximately 9% to 13%. However, for high-end finished products (like stone furniture or custom carvings), the impact is significantly lower, as the value is driven more by craftsmanship than raw material weight.

Q3: Is there a “grace period” or a way to secure current pricing?

A: Yes. The policy officially takes effect on April 1, 2026. Any orders that complete customs declaration and depart from Chinese ports before March 31 will still benefit from the current tax-inclusive pricing. We strongly recommend our partners finalize their Q2 and Q3 requirements by mid-February to ensure sufficient production and shipping time.

Q4: Will this policy lead to supply chain disruptions or supplier closures?

A: The industry is undergoing a “healthy shake-out.” While small-scale workshops with low environmental standards may struggle, established leaders like حجر HRST have already prepared. We have optimized our supply chain and invested in automation to offset these changes. For global buyers, this actually means a more stable, professional, and compliant supply base in the long run.

Q5: How can I mitigate the increased costs for my projects?

A: We suggest two main strategies:

-

Shift to Finished Goods: By importing precision-cut, “ready-to-install” components instead of raw slabs, you save significantly on local labor and waste disposal costs, which often offsets the material price increase.

-

Bulk Procurement: Consolidating orders before the April deadline allows you to lock in current rates and optimize shipping costs.